Cannabis businesses face extraordinary regulatory hurdles, lack access to banking infrastructure and must contend with a shadow industry of unlicensed growers and providers. The industry has been mired with a lack of transparency and equitable playing field that puts them at a disadvantage compared to other businesses. IRS Section 280E is a decades-old law that many industry advocates say must be revised to meet today’s reality.

Background

Section 280E was created in 1982 as a response to a court case the previous year, in which Jeffrey Edmondson, a Minneapolis-based drug dealer, won a lawsuit against the IRS to deduct business expenses. Following the Court’s decision, and to prevent other traffickers from following suit, Congress passed Section 280E to penalize traffickers of Schedule I or II drugs. Marijuana is considered a Schedule I substance under the Controlled Substances Act.

The law disallows the deduction of “ordinary and necessary” business expenses, after reducing gross receipts by cost of goods sold (COGS), and that federal income tax liability be calculated based on gross income.

The Tax Burden

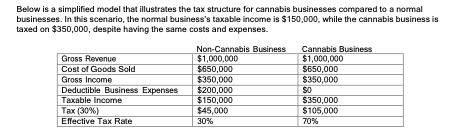

A cannabis business is taxed on 100% of the expenses a “normal” business could write off. These include below-the-line costs such as operating expenses, interest, and taxes. Cannabis businesses often pay tax rates that are 70% or higher than their counterparts in other industries. Refer to the chart below for a clearer illustration:

Source: National Cannabis Industry Association, Internal Revenue Code Section 280 E: Creating An Impossible Situation For Legitimate Businesses

Current Implications

Although Section 280E was created to dissuade dealers of hard drugs from doing business, the law most often affects state-regulated cannabis businesses operating today.

Cannabis is now legal for medical use in 38 states and the District of Columbia, and for adult use in 19 states. 280E is applied to state-regulated cannabis businesses more often than it is to the types of illegal drug trafficking that the law was initially intended to penalize.

The result is that cannabis businesses are obligated to pay onerous Federal taxes that are often greater than real net income. It also skews the balance sheet because being taxed on gross profit creates false taxable income and thereby false profit. This has set up a dynamic where compliant state-legal businesses are being taxed to death, while an illicit market blooms, side-stepping taxes and encroaching on market share.

Solutions

The cannabis industry deserves transparent and fair regulations in order for aboveboard operators and owners to thrive. While legislation continues to be introduced to decriminalize marijuana on the Federal level, to date there seems to be light appetite, under the current administration, to advance reform toward legalization.

What can a cannabis business do, given the present state, to navigate this complicated landscape and manage operations? Below is a list of a few things that a business owner might wish to consider:

- Seek investment or capital from people who want to see the industry succeed in the long term and have experience in the space to help guide you through the complexities.

- Control your business expenses, and don’t expand for the sake of expanding. There are few economies of scale for cannabis businesses.

- Educate your customer about the financial realities of legal product and their associated cost.

- Hire attorneys, tax advisors, financial advisors, and other professionals who have proven experience in the cannabis industry. This is key to building a team of experts who can guide you in the future as regulations change and the industry evolves.

- Research the best business structure for your enterprise to minimize its tax liability under Section 280E.

While Federal cannabis reform may not be in the cards quite yet, California Governor Gavin Newsome has made it easier for MAUCRSA licensed cannabis businesses to operate within the state. MAUCRSA sets up a basic framework for licensing, oversight and enforcement related to cannabis businesses in California. Assembly Bill 37 was signed into law October 2019, eliminating California’s conformity with Section 280E for licensed Personal Income Tax (PIT) cannabis businesses. This bill allows PIT cannabis businesses to deduct ordinary and necessary business expenses on their California income tax return.

During 2020-2021 California collected roughly $817 million in cannabis tax revenue. While there has been a slight decline in revenue this year, the state reports that during the first half of 2022, cannabis tax revenue generated $579 million.

According to Motley Fool, as of March 2022, cannabis-friendly states nationwide reported a combined total of $11.2 billion in tax revenue from legal, adult-use cannabis sales. The Tax Foundation estimates that the market for legal marijuana could reach $30 billion by the end of next year. While still an emerging industry, there is great potential upside for cannabis businesses to thrive with proper guidance, realistic expectations and a dollop of resilience for the long haul.

About Streit Lending

Streit Lending offers short-term construction and bridge loans in Southern California, from $500,000 to $10,000,000 at a loan-to-cost up to 70 percent, to build and rehabilitate commercial and residential properties. Streit can tailor a loan to meet borrowers’ needs and offers quick, transparent and stress-free closings that help clients complete real estate transactions faster.